Whether you’re already a homeowner or you’re looking to become one, the recent headlines about home prices may leave you with more questions than answers. News stories are talking about home prices falling as the market cools. According to 2022 Victoria Real Estate Board President Karen Dinnie-Smyth,

“We began the year with record low inventory, and with higher than average sales, and then the market changed on a dime. Interest rate increases through the remainder of 2022 signaled the end of low-cost borrowing and pushed buyers to the sidelines. Each time interest rates went up, market activity slowed.

As we head into 2023, we continue to see the cost of moving and borrowing money undermine demand. Slower sale activity has resulted in inventory levels rebounding from historic lows, which means there are more opportunities for buyers in our market this year than in recent years.”

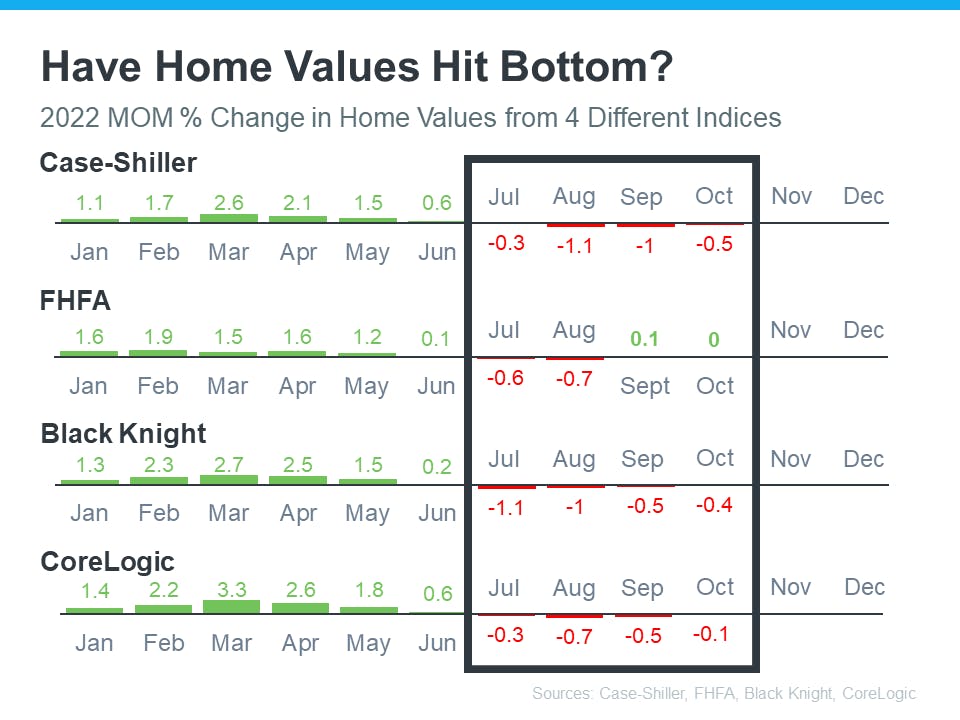

One of the questions that’s on many minds, based on those headlines, is: how much will home prices decline? But what you may not realize is expert forecasters aren’t calling for a free fall in prices. In fact, if you look at the latest data, there’s a case to be made that the biggest portion of month-over-month price depreciation nationally may already be behind us – and even those numbers weren’t significant declines on the national level. Instead of how far will they drop, the question becomes: have home values hit bottom?

Changing Buyer Demand

According to the VREB, home sales decreased across the board as we closed out 2022. This is despite a significant increase in total listings compared to December 2021. Higher interest rates and the Prohibition on the Purchase of Residential Property by Non-Canadians Act, which went into effect at the beginning of this year has contributed to decreased buyer activity.

Some key stats from the December market:

- Single Homes sold 1.7% higher Y/Y

- Condominiums sold 5.6% higher Y/Y

So while homes prices are still increasing, national and local market trends are leading many experts to forecast a decrease in buyer demand this year.

President Dinnie-Smyth adds, “The new year begins with the federal government’s ban on foreign buyers…The cost of housing is unlikely to be affected by this ban because we know from the government’s own data that foreign buyers represent only a handful of transactions in our region in recent years.”

On the local market, Dinnie-Smyth points out that “the Victoria market has already cooled off, which leaves this legislation at least a year out of date and toothless in terms of public protection, as standard condition terms are often longer than the three-day legislated term.”

Bottom Line

The Prohibition on the Purchase of Residential Property by Non-Canadians Act, increasing inventory, and higher interest rates have all contributed to a significantly more competitive market for buyers and sellers alike this year. Factors like home pricing and effective marketing will be incredibly important for sellers looking to get the most value for their home. If you are ready to buy or sell in Victoria this year, the McMullen Homes Team can help.